merleruddell63

About merleruddell63

The Timeless Funding: Exploring the Worth Of Gold

Gold has been revered as a valuable asset for centuries, typically seen as a secure haven during instances of economic uncertainty. Its intrinsic worth, historic significance, and unique properties make it a compelling investment alternative for each seasoned buyers and newcomers alike. This text explores the assorted facets of investing in gold, together with its advantages, dangers, and the alternative ways to speculate.

The Historical Significance of Gold

Gold has been used as a form of currency, jewelry, and a symbol of wealth for 1000’s of years. Historical civilizations, from the Egyptians to the Romans, acknowledged its value, and it has maintained its allure via the ages. In contrast to fiat currencies, which can be printed at will by governments, gold is a finite useful resource. This scarcity contributes to its enduring value, making it a dependable store of wealth.

Why Invest in Gold?

- Hedge Against Inflation: One of the primary causes traders flip to gold is its capability to act as a hedge against inflation. As the price of living rises and the buying power of foreign money declines, gold typically retains its worth. Historically, during intervals of excessive inflation, gold costs have surged, providing a buffer for buyers.

- Protected Haven Asset: Gold is usually viewed as a safe haven during financial downturns or geopolitical tensions. When stock markets are risky, or when there may be uncertainty surrounding political occasions, traders tend to flock to gold, driving up its price. This behavior underscores gold’s popularity as a reliable asset throughout turbulent occasions.

- Portfolio Diversification: Including gold in an funding portfolio can improve diversification. Gold sometimes has a low correlation with other asset lessons, reminiscent of stocks and bonds. Which means that when inventory costs drop, gold could rise or remain stable, helping to mitigate total portfolio threat.

- Global Demand: The demand for gold is driven by numerous sectors, including jewelry, know-how, and central banks. In nations like India and China, gold is culturally important and sometimes bought for weddings and festivals, making a consistent demand that supports its value.

Different Ways to Invest in Gold

Buyers have a number of options when it comes to investing in gold, each with its distinctive advantages and considerations.

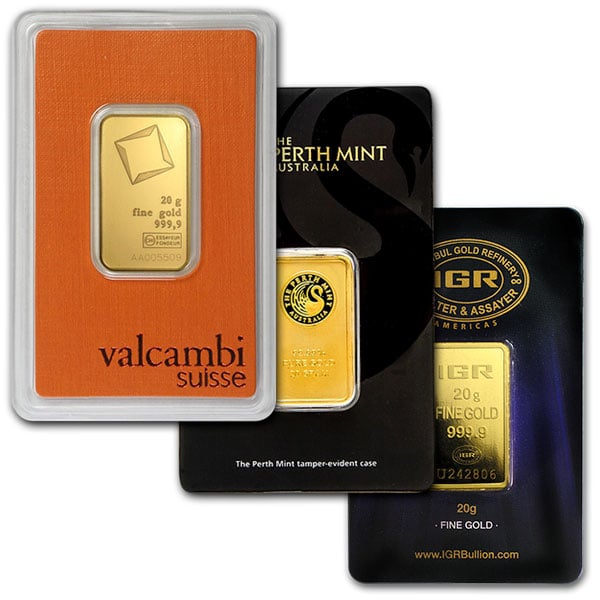

- Bodily Gold: This contains gold coins, bars, and jewellery. Proudly owning bodily gold allows investors to hold a tangible asset. However, it additionally comes with challenges similar to storage, insurance coverage, and liquidity. Buyers must consider these elements when deciding to put money into bodily gold.

- Gold ETFs (Exchange-Traded Funds): Gold ETFs are a popular solution to invest in gold without the need to physically hold it. These funds track the value of gold and can be traded on inventory exchanges like common stocks. They provide liquidity and ease of access, making them a sexy option for many investors.

- Gold Mining Stocks: Investing in gold mining companies is another way to gain exposure to gold. These stocks can offer leveraged exposure to gold prices, that means that if gold costs rise, mining stocks may rise even more. However, investing in mining stocks additionally comes with dangers associated to operational challenges and management decisions.

- Gold Futures and Choices: For extra skilled investors, gold futures and options offer a solution to speculate on the long run worth of gold. These financial instruments can present significant returns, but in addition they carry a high level of risk and complexity. Investors should fully understand these products before participating in buying and selling.

- Gold Certificates: Some banks provide gold certificates, which signify possession of a particular amount of gold stored in a vault. This option offers a solution to invest in gold without the trouble of bodily storage, however buyers ought to be certain that the issuing institution is respected and that the gold is backed by physical reserves.

Risks of Investing in Gold

While gold has many benefits, it is important to pay attention to the risks related to investing on this valuable metal.

- Worth Volatility: Gold prices could be highly unstable, influenced by components akin to world economic situations, interest rates, and foreign money fluctuations. This volatility can result in significant value swings in a short period, which may not be appropriate for all buyers.

- Lack of Revenue Technology: Unlike stocks or bonds, gold does not generate earnings. Investors do not obtain dividends or curiosity payments, which can make gold much less attractive for these seeking common income from their investments.

- Storage and Insurance Costs: For those investing in physical gold, there are additional costs related to storage and insurance coverage. These bills can eat into profits, particularly if gold costs do not rise considerably.

- Market Manipulation: The gold market can be subject to manipulation, particularly by large institutional gamers. This can create uncertainty for particular person buyers and may result in unexpected worth movements.

Conclusion

Investing in gold generally is a invaluable addition to a diversified investment portfolio. Its historic significance, capability to hedge against inflation, and status as a secure haven asset make it a beautiful choice for many investors. Nonetheless, it is crucial to consider the assorted ways to invest in gold, as well because the related dangers. If you cherished this article and also you would like to receive more info with regards to buynetgold.com generously visit the page. Whether or not by means of physical gold, ETFs, mining stocks, or different methods, understanding the dynamics of the gold market may also help traders make knowledgeable selections. As with all funding, thorough analysis and a clear strategy are crucial to navigating the complexities of gold investing successfully.

No listing found.